Advertiser DISCLOSURE

“The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.”

Alright everybody, are you ready for the ultimate Chase Ink business credit card showdown? Let’s take a minute and compare:

There are four Chase Ink Business credit cards to pick from. Below are the 3 that I recommend over and over:

· Chase Ink Business Unlimited® Credit Card

· Chase Ink Business Cash® Credit Card

· Chase Ink Business Preferred® Credit Card

Referral Link. All information about the Ink Business Preferred® Credit Card has been collected independently by Amber on Points. The Ink Business Preferred® Credit Card is no longer available through Amber On Points.

All options include a generous welcome offer and travel perks, but there are various ways to receive those rewards.

The Ink Unlimited and Ink Cash are marketed to be cash back cards (which is a great option!!). But, if you or someone in your household happens to hold the Chase Sapphire Preferred® Card, the Chase Sapphire Reserve®, or the Ink Business Preferred, you can combine the rewards to receive points, rather than cash back. This opens up so many possibilities! The option to utilize them with Chase Travel℠ or transfer the rewards to select travel partners is my favorite.

That was a mouthful. Let me simplify it for you.

Ink Business Unlimited

This cash back credit card earns 1.5% cash back on EVERY purchase. Combine the points with one of the cards I mentioned above, such as Sapphire Preferred and suddenly you have access to Chase Travel℠. This will give you access to travel partners such as Southwest, Hyatt, Air France, and more! Did we mention there is no annual fee on this card? You just can’t beat it!

This card also offers travel purchase protection, coverage for travel and emergency assistance services, auto rental collision damage waiver, and more!

Ink Business Cash

Much like the Ink Unlimited, this is a cash back credit card that earns 5% back (on the first $25,000) spent at office supply stores. It also earns 5% back on internet, cable and phone services. Additionally, you will earn 2% cash back on gas stations and restaurants up to a combined $25,000. All other purchases will receive 1% back. Combine the points with one of the cards I mentioned above, such as Sapphire Preferred and you’ll have access to Chase Travel℠ and travel partners. These are huge perks for a $0 annual fee card!

Ink Business Preferred

Lastly, the Ink Preferred gives you instant access to transferring your points through Chase Travel℠. Check out the most recent offer here. This card has a $95 annual fee, but the perks are well worth it.

Travel perks include 3x points on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable and phone services, and on advertising purchases made with social media sites and search engines each account anniversary year. All other purchases will receive 1x points. This card also ensures travel and purchase protection, such as trip cancellation and primary rental car insurance.

Referral Link. All information about the Ink Business Preferred® Credit Card has been collected independently by Amber on Points. The Ink Business Preferred® Credit Card is no longer available through Amber On Points.

How Do I Turn My Cash Back into Points?

Step 1: Log into your Chase app. Select the Ink Business Cash or Ink Business Unlimited Card.

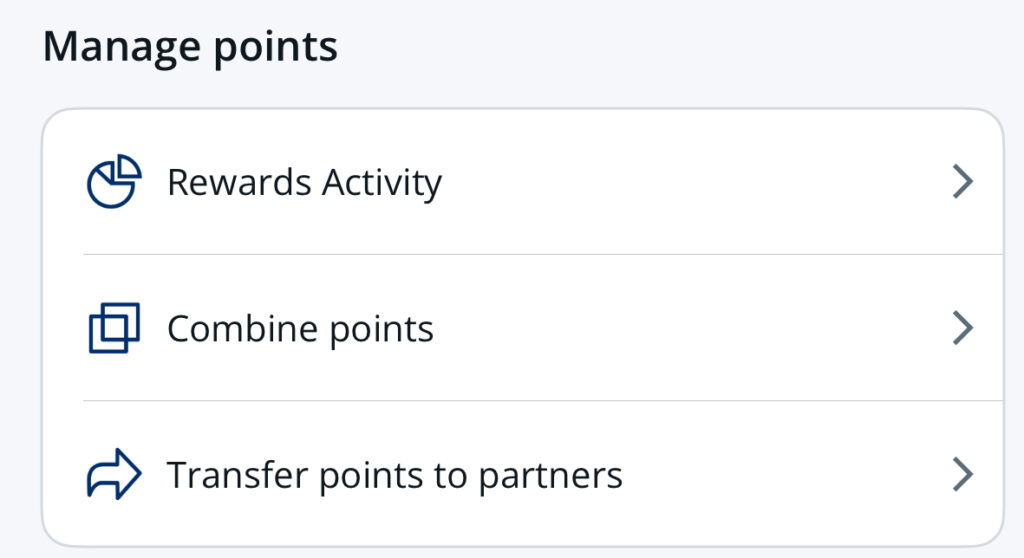

Step 2: Tap “Benefits & Rewards”. Tap “Redeem Rewards”.

Step 3: Tap “Combine Points”

You will now transfer your rewards from your Ink Business Cash or Ink Business Unlimited to one of your flexible Chase point earning annual fee cards, such as the Sapphire Preferred. Complete your transfer

Step 4: You then will have the ability to transfer your points to travel partners such as Hyatt, Southwest, United, and more. You will typically get ultimate value by transferring points to transfer partners!

Cards that transfer out to transfer partners:

The New Chase Sapphire Reserve®

Chase Sapphire Reserve for Business®

Ink Business Preferred

Which Card is Right for You?

Let’s sum up this Chase Ink business credit card showdown:

· Ink Business Unlimited: Perfect if you want a straightforward 1.5x rewards card with no annual fee and flexible cash back. I recommend using it hand in hand with the Sapphire Preferred or Ink Business Preferred for access to Chase’s fantastic travel partners.

· Ink Business Cash: Great for those who want high cash back rates in specific categories without an annual fee. I recommend using it hand in hand with the Sapphire Preferred or Ink Business Preferred for access to Chase’s fantastic travel partners.

· Ink Business Preferred: Ideal for travelers who want to maximize points with higher earnings on travel and business expenses and enjoy robust travel protections. You can access Chase’s travel partners with this card, which I highly recommend!

I can’t wait to see what card you choose and where you end up going! Thank you again for using my links when you apply for a credit card. This allows me to keep producing free content at zero cost to you, and I appreciate it so much!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.

Amberonpoints is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. We appreciate it when you use our affiliate links as it supports our content at no cost to you!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.