Advertiser DISCLOSURE

Earn Two Southwest Companion Passes

If you’re familiar with the Southwest Companion Pass (which essentially gives you BOGO flights for almost 2 full years), BUTTTTT you feel you need to earn two Companion Passes to really make family travel possible, then this blog article is for you.

I’ve recently had some friends with larger families reach out to me for step by step instructions on how to earn not one but TWO Southwest companion passes, simultaneously. Before we get started, I want to mention that the offers I have mentioned are the standard offers. Sometimes you will see elevated offers! If that is the case – this is fantastic! You can never have too many extra points. Here we go.

Big Picture

In order to earn the Southwest Companion Pass, you need to earn 135,000 points in one calendar year (January – December). Meaning, if you earn some of the points in December and the rest in January, you won’t earn it. So timing is KEY. To complicate things even more, if you are interested in TWO companion passes, that adds an extra element where timing is crucial!

Step 1:

In October or November ideally (but really any time before January 1st), you (we will call you Player 1) open the Southwest® Rapid Rewards® Performance Business Credit Card. The standard offer for this card will allow you (Player 1) to earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. You should know that offers change – so be sure to check the offer when you apply! You CANNOT hit the minimum spend until Jan. 1st. I would 100% spend $4000 and then put it in a drawer until January 1st. Chase is known to deliver bonus points early. Here is the current offer on this card:

Step 2:

The last week of the year, you will refer your spouse/partner/player 2 to the same card. I would start with this same one – the Southwest® Rapid Rewards® Performance Business Credit Card (don’t use my link, send your Player 2 your referral link). If your spouse/partner/player 2 opens this card in late December, make sure that they DO NOT hit the minimum spend this calendar year. Your Player 2 needs to wait until after January 1st. When you refer Player 2, this will give you (Player 1) 20k referral points.

Step 3:

After 30 days or more (yes – you need to wait this long), you will refer your Player 2 to the Southwest Rapid Rewards® Plus Credit Card. This is a personal card. This will give you (Player 1) 20k referral points. Your Player 2 will need to make sure to meet the welcome offer after January 1st.

The Breakdown to Earn Two Companion Passes

Player 1:

80k points from Southwest® Rapid Rewards® Performance Business Credit Card + 20k Referral points + 20k Referral points + Points from spending + complimentary 10k Southwest Companion Pass Qualifying Points for holding a card on Jan 1st = 135k+ points and the companion pass. (Note: What if I start this process late and am not holding a card on January 1st? No problem – you will just need to continue spending on your card until you’ve earned the additional points. This is extremely doable!)

Player 2:

80k points from Southwest® Rapid Rewards® Performance Business Credit Card + 50k points from the Southwest Rapid Rewards® Plus Credit Card (This is the standard offer. You’ll want to see what the current offer is when you apply for the card.) + 10k points from holding a card at the beginning of the year = 135k+ points and the companion pass.

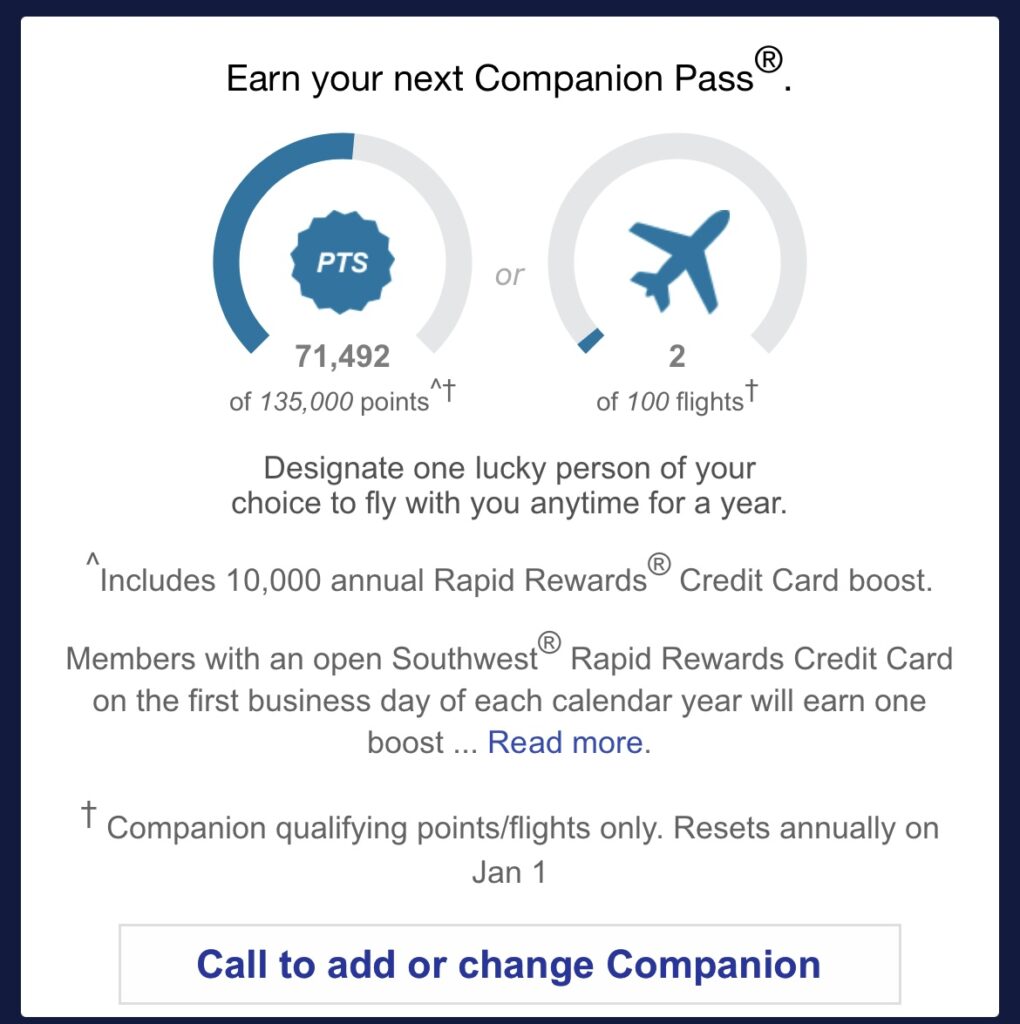

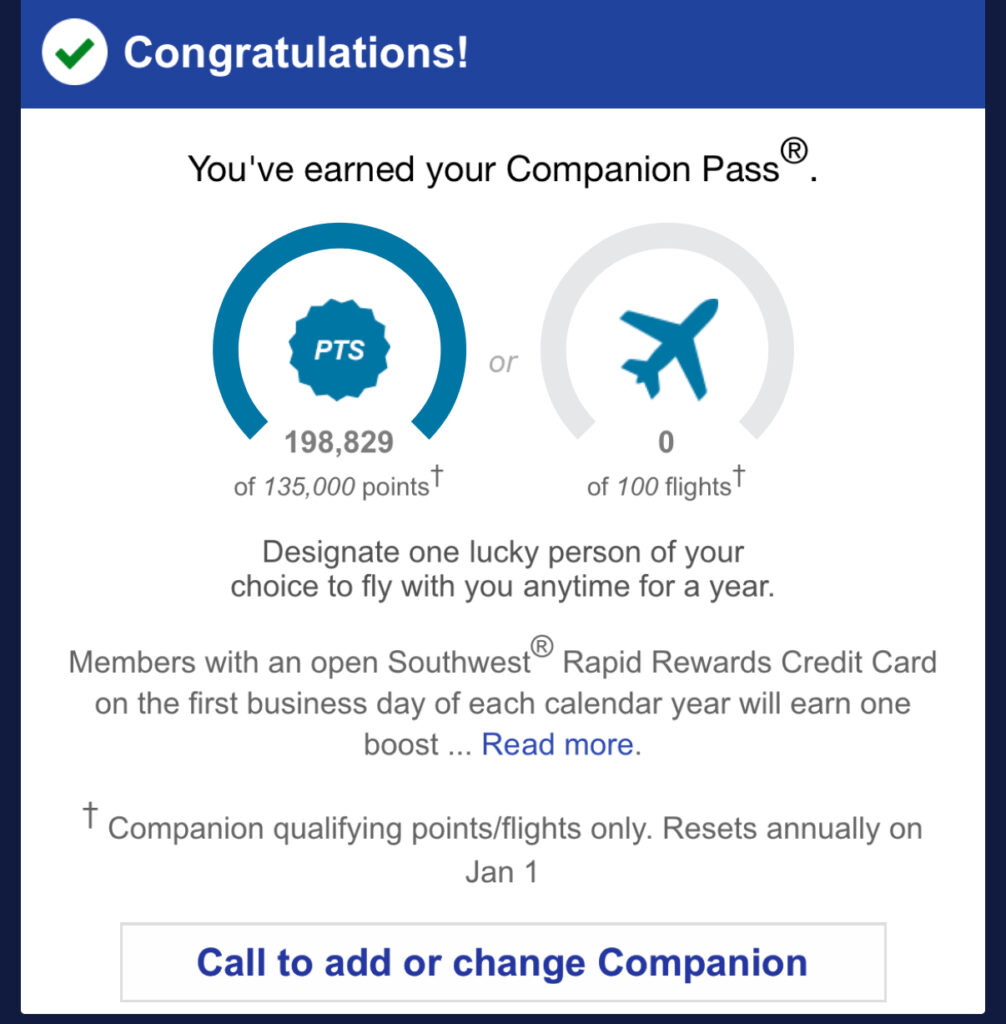

At any time during this process, if you get confused, I recommend logging into the app. Once you are there, tap the person icon on the top right. Tap the orange graphic under “My Rapid Rewards.” You should see something like this:

I always like double and triple checking to ensure that I am on the right path! I hope this information helps! If you have any questions – shoot me an email at hello@amberonpoints.com or message me on Instagram. Happy to help!

I’m sure you know this, but I earn a commission from Chase bank when you open this card and am so grateful when you support my small business by using my links!

Let’s get you traveling on points!

xo – Amber

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.

Amberonpoints is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. We appreciate it when you use our affiliate links as it supports our content at no cost to you!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.