Advertiser DISCLOSURE

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. “All information about the American Express® Green Card and Hilton Honors American Express Aspire Credit Card have been collected independently by Amber on Points. American Express® Green Card and Hilton Honors American Express Aspire Credit Cards are no longer available through Amber on Points.”

Today we’re talking about something that’s notoriously difficult to do: booking cruises on points. Typically when we talk about booking cruises on points, you’ll hear people mention using the purchase eraser from Capital One, using a travel portal or that it’s a ‘points earning trip’. But sometimes you just want a great cruise bookable with points!

That’s where Virgin Voyages comes in. Virgin Voyages is part of the larger Virgin Group, owned by Richard Branson. Their cruise line is an adults – only cruise line whose goal is to create the perfect balance of luxury, vibrant social atmosphere and fabulous food and entertainment.

And here’s the great part – all sailings are available to book with Virgin Red points.

Pricing starts at about 305,000 for a 4 day cruise departing from Miami, Florida. And you’re going to book right into a balcony cabin! More on that later.

HOW TO EARN VIRGIN POINTS

Virgin Red points are fairly easy to accrue. That’s because you can transfer them from Virgin Atlantic Flying Club. Is this clear as mud? Stick with me for a minute.

Virgin Red and Virgin Atlantic Flying Club are two different programs under Virgin Group. But you can combine points between the two programs seamlessly at a 1:1 ratio. (It’s kind of like British Airways Avios, Iberia Avios, Qatar Avios and so on!)

Here’s the good news: It’s really easy to earn Virgin Atlantic points because all major banks transfer to them!

WHICH BANKS TRANSFER

The following banks all transfer at a 1:1 ratio to Virgin Atlantic

- American Express Membership Rewards

- Bilt Rewards ( a rewards system…not a bank, but you get the idea)

- Capital One Miles

- Chase Ultimate Rewards

- Citi ThankYou Points

- Wells Fargo

Marriott points also transfer to Virgin Atlantic at a 3:1 ratio. For every 60,000 points transferred you’ll also receive a 5,000 bonus.

Stick around until the end of the article and I’ll list out all the cards that earn Virgin Atlantic points! ?

TRANSFER BONUSES

Periodically there will be a transfer bonus from one of the major banks to Virgin Atlantic. Transfer bonuses of anywhere from 25%-40% have been seen in the past. Keep this in mind because if you snag a transfer bonus, your cruise might become a screaming deal!

You can find a list of current transfer bonuses here!

LINKING YOUR VIRGIN RED AND VIRGIN ATLANTIC ACCOUNTS

You need to ensure your Virgin Red account is linked to your Virgin Atlantic account so you can get those points combined into the correct account!

You can read all about linking your account here directly from Virgin. But it’s super easy. You log into your Virgin Red account, click on your profile and click “Link Accounts”.

From there you can add in your Virgin Atlantic number and voila! You’re ready to book some cruises. Virgin points are not actually ‘transferred’ between the two programs – but rather they show as a combined points balance across both programs.

BOOKING YOUR CRUISE ON POINTS

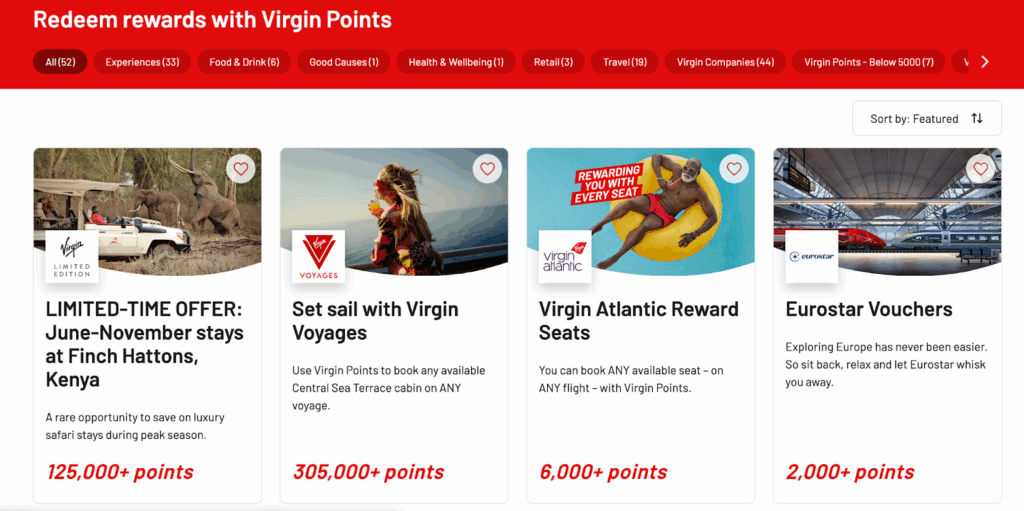

Redeeming Virgin Points landing page

You’ll begin by going to the Virgin Red website. Click on “Rewards” at the top of the screen. You’ll have several options to redeem your Virgin points. You can either access the cruises with the large featured Virgin Voyages thumbnail or by clicking the Travel tab at the top of the screen.

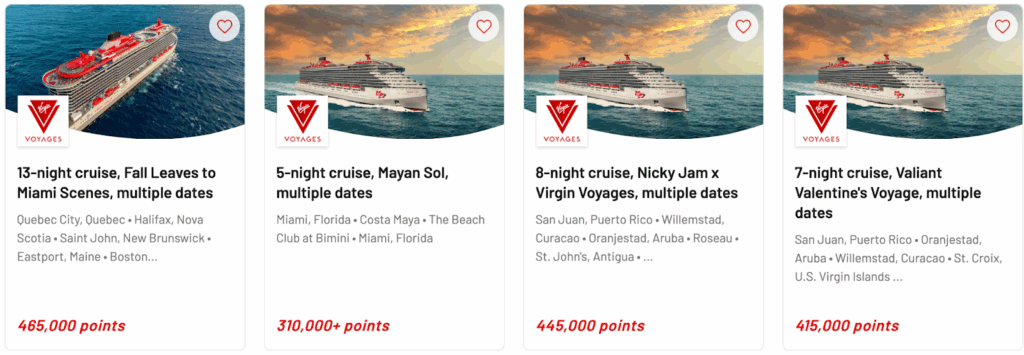

Sample bookings from Virgin Voyage

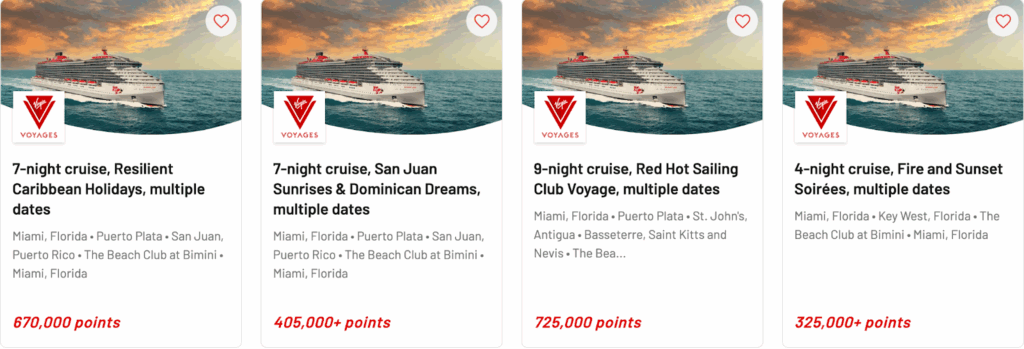

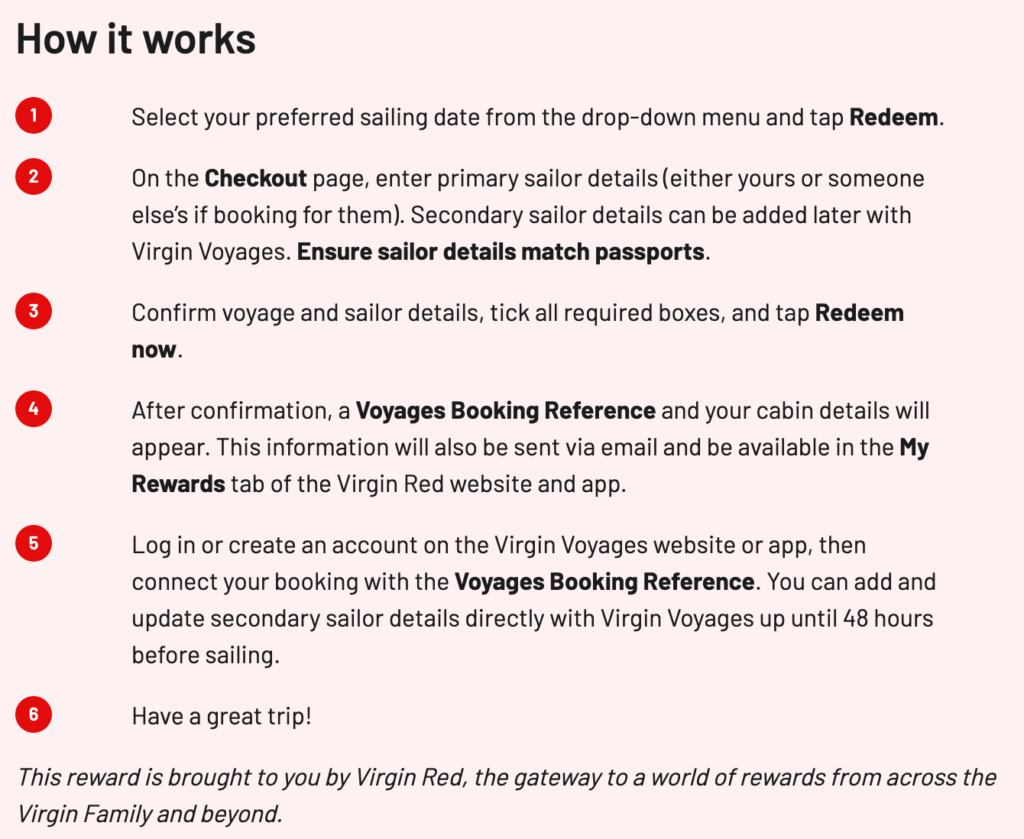

Choose your preferred sailing and the date you’d like to sail. Points vary depending on itinerary popularity and dates. I don’t have any Virgin Red points in my account so I couldn’t complete a mock booking but the instructions are very clear. I grabbed a screenshot and posted it below for you to see how well the instructions are laid out.

Sample dates and clear instructions for redeeming points

Prior to booking, make sure to read Virgin Voyage’s Terms and Conditions to ensure you’re aware of the cancellation policy, inclusions, entry requirements and the like.

WHAT IS INCLUDED IN THE (POINTS) PRICE?

Central Sea Terrace cabin

Okay, you’re going to love this. The points price includes the following:

- A Central Sea Terrace cabin for two adults.

- Tips and Gratuities

- WiFi for two adults

- Soda package

- 20+ dining venues

- All entertainment

- Fitness classes

IS IT WORTH IT?

If you’re looking to spend as little out of pocket cost as possible – then yes, you should always book with points! However it’s worth it to always consider the cash price of your cruise before pulling the trigger on using your points.

I compared the cash price vs points price on a random sailing departing Miami labeled “San Juan Sunrises and Dominican Dreams”.. The cash price for a Central Sea Terrace cabin came to $3,222. The same sailing cost 405,000 Virgin Red points. That’s 0.80 cents per point. Not the best value. But when you consider how easy it is to earn these points, it may be a great way to take the trip you want.

However, if you are able to transfer points to your Virgin Red account during a transfer bonus, it could be much more lucrative!

A 25% transfer bonus would mean that you need 324,000 points – meaning your cent per point value is 0.99.

A 35% transfer bonus brings the cost down to only 300,000 points – giving you a 1.07 cent per point value.

CARDS THAT EARN VIRGIN RED POINTS

There’s a lesser known card that earns Virgin Red points directly! The Virgin Red Mastercard!

The following transferable currency cards earn Virgin Atlantic points, which will need to be transferred to your Virgin Red account as described above.

American Express

- American Express® Green Card: $150 Rates & Fees

- American Express® Gold Card: $325 Rates & Fees

- American Express Platinum Card®: $895 Rates & Fees

- The Blue Business® Plus Credit Card from American Express: $0 Rates & Fees

- American Express® Business Green Rewards: $95 Rates & Fees

- American Express® Business Gold Card: $375 Rates & Fees

- The Business Platinum Card® from American Express: $895 Rates & Fees

- Bilt Blue Card: $0

- Bilt Obsidian Card: $94

- Bilt Palladium Card: $495

Capital One

- Capital One VentureOne Rewards Credit Card:$0

- Capital One Venture One For Good Credit Card: $0

- Capital One Spark 1.5X Miles Select for Business Card: $0

Chase

- Chase Sapphire Preferred® Card: $95

- Chase Sapphire Reserve®: $795

- Chase Sapphire Reserve for Business®: $795

- Chase Ink Business Preferred ® Credit Card: $95

- Chase Freedom Flex®:$0

- Chase Freedom Unlimited®:$0

- Chase Ink Business Cash® Credit Card:$0

- Chase Ink Business Unlimited® Credit Card:$0

*note that you must have one of the top four Chase cards in your portfolio to transfer points to partners.

Citi

- Citi Strata Elite℠ Card: $595

- Citi Strata Premier® Card: $95

- Citi Strata℠ Card: $0

- Citi Prestige® Card: (no longer open to new applicants)

- Citi Custom Cash® Card: $0

- Citi Double Cash® Card: $0

- Citi Rewards+® Card: $0

Wells Fargo

- Wells Fargo Autograph Journey℠ Card: $95

- Wells Fargo Autograph® Card: $0

Marriott (Transfer 3:1 with 5K point bonus for every 60K transferred)

- Marriott Bonvoy Bold® Credit Card: $0

- Marriott Bonvoy Boundless® Credit Card: $95

- Marriott Bonvoy Bountiful™ Card: $250

- Marriott Bonvoy Bevy® American Express® Card: $250. Rates & Fees

- Marriott Bonvoy Brilliant® American Express® Card: $650 Rates & Fees

- Marriott Bonvoy Business® American Express® Card: $125 Rates & Fees

CONCLUSION

I think this can be a great way to book cruises on points – especially given how easy Virgin points are to accrue across the major banks. While some cruises may appear to be less than ideal in cents per point (if you’re even tracking that!), keep in mind all that is included with the price of the points. Taxes, gratuities, food, drinks, entertainment, WiFi and multiple port stops can make this a great deal – regardless of what the ‘cents per point’ says. This is sure to be a memorable vacation booked on points!

xoxo Amber

Have questions? Chat with me here.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.

Amberonpoints is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. We appreciate it when you use our affiliate links as it supports our content at no cost to you!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.