Advertiser DISCLOSURE

January 16, 2026

Earn Credit Card Points on Your Mortgage?! The Ultimate Guide To Bilt Rewards

back to the blog

UPDATE: 2 days after the new Bilt 2.0 launched and after lots of mixed reviews, Bilt came out with some changes. Updates to this article coming soon!

Bilt 2.0 has been one of the most anticipated new cards in a long time. A LONG time.

In fact, I planned on getting this card before I even heard the details.

So let me start by telling you this very clearly: this card is NOT for everyone.

It will make sense for many of you.

For many of you, it will not.

And to make things even more confusing… some of you might get the card and not use it to pay your mortgage.

#makeitmakesense

But is opening a new card to pay your mortgage really that simple?

Nope. It’s not.

It’s actually… kind of complicated.

So let’s walk through it together.

Before We Talk About the Cards, You Need to Know This

You do NOT need a Bilt credit card to earn Bilt Rewards.

This is important.

There are four major banks — Chase, Citi, American Express, and Capital One.

Bilt is not a bank.

It is a rewards ecosystem.

In fact, you should already be earning Bilt Rewards. Start by creating an account here. Add some cards that you typically currently use at restaurants and in your everyday life to your account. Link your Bilt account to your Lyft account. Use your cards. Why? Well Bilt has partnerships with restaurants and other merchants in your community. If you have your cards linked, when you use them when you’re out and about, sometimes you’ll be surprised with points in your Bilt account.

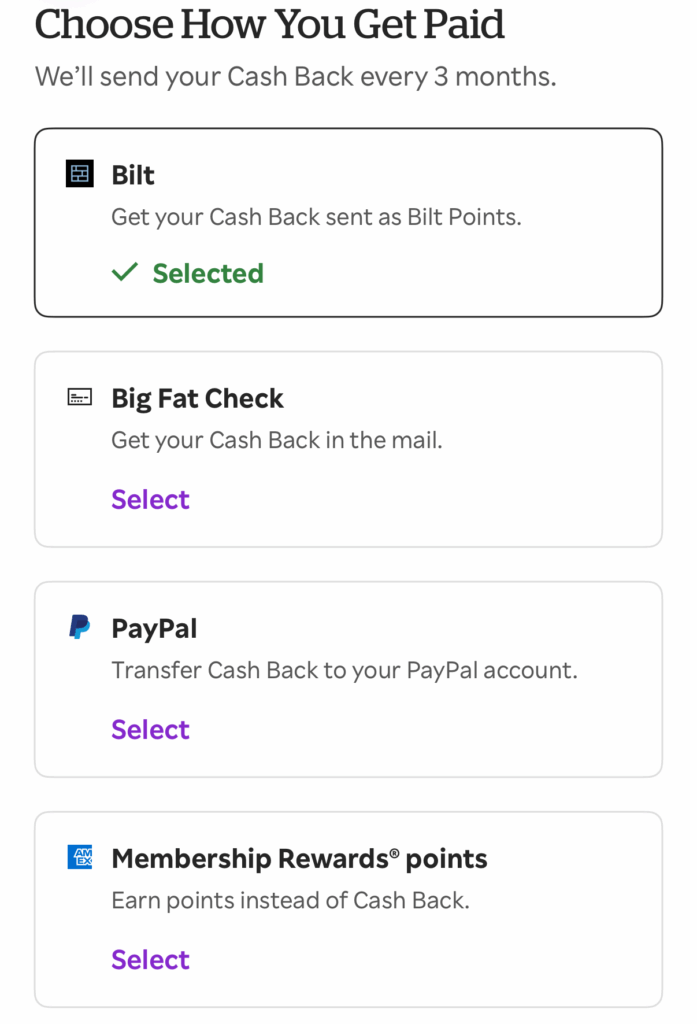

Now if you want to amplify that spending, this is what we were made for – online shopping. We are going to create a Rakuten account (use the same email address as your Bilt account), and click through the Rakuten account on our normal shopping. You’ll get extra cash back or Bilt points by using this referral link.

I promise – we are getting to the cards.

Why Bilt 2.0 Is a Big Deal

Bilt Rewards started as a way for renters to earn points on their largest monthly expense — rent.

For years, people have asked: “Will we ever be able to pay a mortgage and earn points?”

This week, Bilt made that happen.

But – and this is important – it’s not as simple as it sounds.

Bilt needs to be profitable. And the reality is, you can’t run a sustainable company if people only swipe for their mortgage and nothing else.

I get it.

Because truthfully?

My original plan was to open a Bilt card, pay my mortgage… and keep opening other cards for welcome offers.

Bilt had to strike a balance.

This is the balance they landed on.

Are You Ready for the Cards?

Actually…scratch that. I don’t think you’re ready yet.

There’s one more thing you need to understand first — because this is where everything clicks.

Bilt Created a Second Currency

As of yesterday, Bilt now has two separate currencies:

- Bilt Rewards (aka Bilt Points)

- Bilt Cash

Bilt Rewards (Bilt Points)

Bilt Points are earned on housing-related expenses (originally rent, now mortgage), everyday spending, and partner purchases.

When you choose to earn Bilt through Rakuten, you’re earning Bilt Points.

These points can be transferred to some of the best travel partners out there, including Hyatt, Alaska Airlines Mileage Plan, Southwest Airlines, and more.

| Airline Program | Transfer Ratio |

|---|---|

| Aer Lingus AerClub | 1:1 |

| Air Canada Aeroplan | 1:1 |

| Air France–KLM Flying Blue | 1:1 |

| Alaska Airlines Mileage Plan | 1:1 |

| Avianca LifeMiles | 1:1 |

| British Airways Executive Club | 1:1 |

| Cathay Pacific Asia Miles | 1:1 |

| Emirates Skywards | 1:1 |

| Etihad Guest | 1:1 |

| Iberia Plus | 1:1 |

| Japan Airlines (JAL) Mileage Bank | 1:1 |

| Qatar Airways Privilege Club | 1:1 |

| Southwest Rapid Rewards | 1:1 |

| Spirit Airlines Free Spirit | 1:1 |

| TAP Air Portugal Miles&Go | 1:1 |

| Turkish Airlines Miles & Smiles | 1:1 |

| United MileagePlus | 1:1 |

| Virgin Atlantic Flying Club | 1:1 |

| Virgin Red | 1:1 |

| Hotel Program | Transfer Ratio |

|---|---|

| World of Hyatt | 1:1 |

| Hilton Honors | 1:1 |

| IHG One Rewards | 1:1 |

| Marriott Bonvoy | 1:1 |

| ALL – Accor Live Limitless | 3:2 |

Bilt Cash

Bilt Cash is brand new — it was created this week.

It’s a second rewards currency inside the Bilt ecosystem (remember — ecosystem, not bank).

It’s earned alongside Bilt Points, but it is not the same thing.

You can use Bilt Cash for:

- Select partner restaurants

- Fitness studios

- Hotels in the Bilt travel portal

- Access to experiences

- Unlocking elite perks and bonuses

Unlike Bilt Points – which shine when transferred to travel partners – Bilt Cash has fixed, dollar-for-dollar value inside the Bilt ecosystem.

Important:

These new cards earn both Bilt Points and Bilt Cash – but they are not interchangeable.

(I know. You are probably thinking…”This is random?” Keep reading.)

Alright. NOW We Can Talk About the Cards

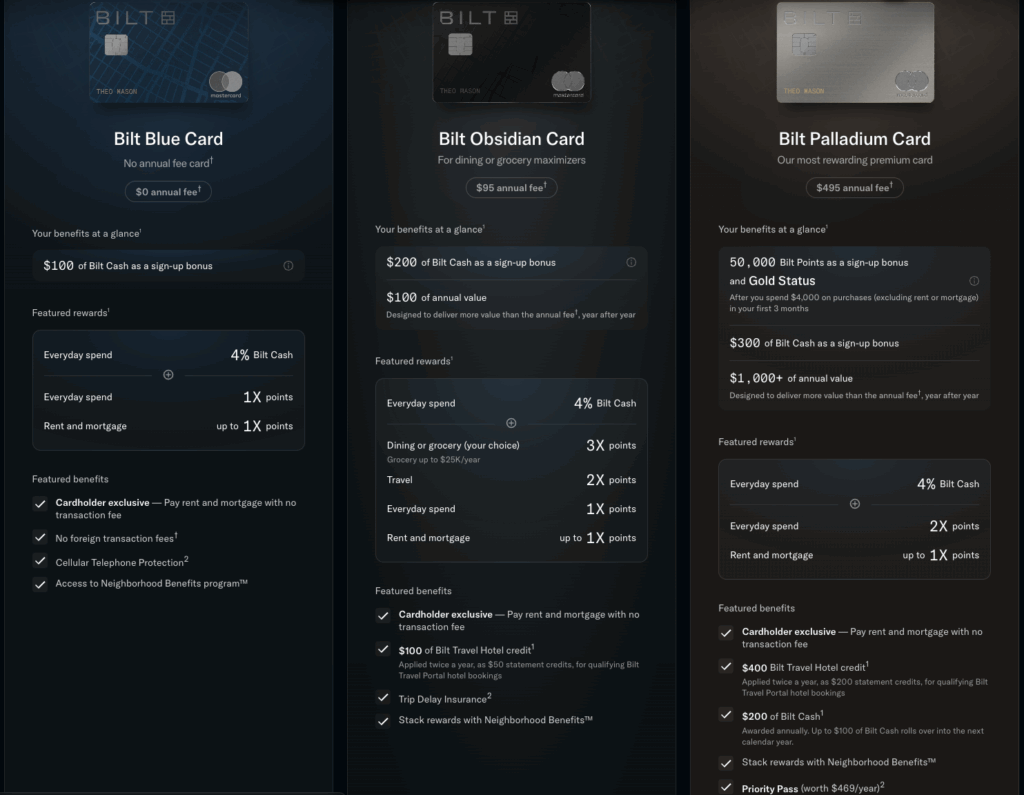

Image from Bilt.com

Bilt Blue Card (No Annual Fee)

Annual Fee: $0

Best For: Budget-conscious renters or new rewards earners

- Earn up to 1X Bilt Points on rent and mortgage

- 1X Bilt Points + 4% back in Bilt Cash on everyday purchases

- $100 Bilt Cash welcome bonus

- No foreign transaction fees

Bilt Obsidian Card ($95 Annual Fee)

Annual Fee: $95

Best For: Dining or grocery spenders

- 3X Bilt Points on dining or grocery (up to $25,000/year)

- 2X Bilt Points on travel

- 1X Bilt Points on other purchases

- 4% back in Bilt Cash

- $200 Bilt Cash welcome bonus

- ~$100 annual hotel credit

- No foreign transaction fees + travel protections

Bilt Palladium Card ($495 Annual Fee)

Annual Fee: $495

Best For: Frequent travelers & high spenders

- 2X Bilt Points on everyday purchases

- 4% back in Bilt Cash

- Up to 1X Bilt Points on rent and mortgage

- 50,000 Bilt Points (limited-time bonus)

- ~$300 Bilt Cash at opening

- Priority Pass + premium Mastercard perks

- ~$600+ in annual value

Here’s Where Things Get Confusing (But Important)

You know when you try to pay for a repair with a credit card and they say:

“Sure — but there’s a 3% fee”?

Then you start doing mental gymnastics to decide if it’s worth it?

That’s basically what’s happening here.

Yes — you can earn Bilt Points when paying your mortgage.

But to earn points, there is effectively a 3% cost unless you unlock the points another way.

You Have Three Options to “Unlock” Points on Mortgage Payments:

- Pay $30 per $1,000 in real money (If your mortgage is $2000, you’d need $60)

- Pay $30 in Bilt Cash per $1,000 (If your mortgage is $2000, you’d need $60 in Bilt Cash)

- Spend 75% of your mortgage amount on the card each month (If your mortgage is $2000, you’ll need to spend $1500 on non-mortgage expenses like gas, groceries, etc.)

If you do option #3, there is no fee and you earn points on your mortgage.

My Hesitations (Because You Know I Have Them)

I know. That’s a lot of math.

The Pros –

- Potentially earn points on your largest monthly expense

- Incredible airline and hotel transfer partners

The Cons –

- Points aren’t unlocked unless you spend on the card

- If you’re working on other welcome offers, spending on both cards can complicate things

- High mortgages = high required spend

- Sometimes… the math just doesn’t math

Real-Life Example (Ours)

We bought our house back in the days of good interest rates and right before a housing boom, but we live in Texas so we have high property taxes.

Our mortgage: $1,800/month

75% spend required:

$1,350/month on the Bilt card

OR…

Use $54 in Bilt Cash

($1,800 × 3%)

That would allow me to:

- Earn 1,800 points on my mortgage

- Plus points on the $1,350 of spending

- Earn Bilt Cash and Bilt Points for my spending depending on the card

Now compare that to…

$5,000 Mortgage Example

- Required spend: $3,750/month

- OR $150 in Bilt Cash

👉 That’s where this stops making sense for some people if they are still interested in opening other cards to maximize welcome offers.

Not to brag, but I made you a Mortgage Calculator. See if it makes sense for you!

Bilt Mortgage Calculator

You only need to meet one of these options to earn points on your mortgage.

Is it a Practical Choice for You?

That’s the right question — and the answer depends entirely on your spending habits.

If you have a high mortgage and lower monthly spend, Bilt may not be worth prioritizing.

If most of your points come from welcome offers, you might sit this one out (or wait if you aren’t in a hurry).

But if you:

- Already spend enough each month

- Want to earn points on money you’re already spending

- Know how to transfer points for high value (Hyatt, Japan Airlines, Alaska Airlines, etc.)

Bilt could be a very compelling option.

For my family?

I’m leaning toward the Palladium — but not necessarily for my mortgage every month.

It might be a good card to use when when I’m not working on a new welcome offer. Earning 2X Bilt Points on everyday spend makes it a strong in-between welcome offer card because it would allow me to earn 2x Hyatt points per dollar spent. It would mostly give me status to keep earning Rakuten points at a 1:1 transfer ratio, and that is important to me. Maybe I’ll open it for science and tell you how it goes.

And honestly?

I planned on getting this card before the details were announced.

Then I heard the details and talked myself out of it.

And by the time I finished writing this article… I talked myself back into it. I’m not sure that the Palladium would be a long term card for me. I’ll keep you posted. 🙂

Welcome to life as a credit card nerd.

Conclusion

Bilt Rewards is no longer just a rent points program — it’s becoming a full-scale rewards ecosystem. With expanding earning opportunities, strong transfer partners, and a flexible card lineup on the horizon, Bilt is quietly one of the most compelling programs in the points and miles space.

As the program continues to evolve, it’s worth keeping Bilt on your radar — whether you rent, own, or simply want smarter ways to earn transferable points on everyday spending. Does the math, math for you? Will you be going for one of these cards?

xoxo, Amber

Questions or comments? Chat with me here.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.

Amberonpoints is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. We appreciate it when you use our affiliate links as it supports our content at no cost to you!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.