Advertiser DISCLOSURE

Unlock the hidden Chase Sapphire Preferred® Card benefits you didn’t know about. Most people know the Chase Sapphire Preferred® Card for its generous welcome bonus and valuable travel rewards. But that’s only half the story.

Behind the points and miles are a suite of underrated perks that can save you hundreds (or even thousands) each year. From built-in trip protection to rental car coverage and monthly food delivery credits, here’s a closer look at the Sapphire Preferred benefits you might be overlooking.

Here are my favorite card perks you probably aren’t using…

TRAVEL BENEFITS

Trip Cancellation and Delay Insurance

You get free trip cancellation insurance, and your immediate family does as well! Coverage amount is up to $10,000 per person and $20,000 per trip. So don’t panic next time you wake up with a sick child on the day of your trip. You’re covered!

While you don’t have to put the entire trip on your Sapphire Preferred card to be eligible for this benefit, I think it’s worth it to put a significant portion of your trip on this card if possible.

If you’re booking award flights, this is a great card to put airline taxes/fees on in order to be eligible for the trip cancellation insurance.

Likewise, if your trip is delayed by more than 12 hours, you’re eligible for up to $500 per ticket. Expect reimbursement for reasonable expenses like lodging and meals.

Primary Car Rental Insurance

A lot of travel credit cards carry car rental insurance. But the Sapphire Preferred offers primary rental coverage for no additional cost to you. This means the CSP will pay for the damage without needing to get your personal car insurance involved.

All you have to do is charge the full amount of the car rental to your Sapphire Preferred card. Bonus points (literally) because you’ll earn 2x points on your car rentals.

Car rental reimbursement accounts for theft, damage, valid loss-of-use charges, administrative fees, and reasonable towing charges related to covered incidents. You can read more about the details of this benefit here.

Book a Hotel in the Portal

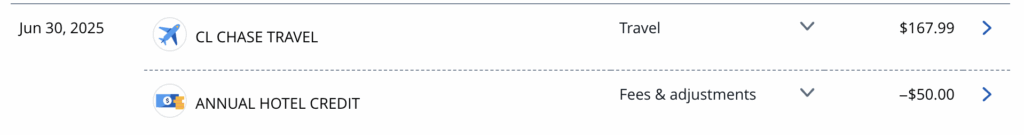

Every account anniversary year, you’re gifted $50 in statement credit for hotels booked within the Chase Travel Portal. If you book a hotel on a cash rate in the travel portal, you’ll be reimbursed for $50!

In my experience, the portal reimburses the $50 quickly. In the photo below, my $50 was credited the same day. My stay at Hyatt Midway Airport also showed up in my Hyatt app immediately. I put my loyalty number in and received an elite night credit. Your results may vary though with securing elite nights and loyalty status perks when booking through the portal.

Roadside Assistance

This hidden benefit is a real gem! Sapphire Preferred customers are eligible for roadside assistance. This is a benefit that requires no preregistration.

Services include:

- Towing up to 5 miles (pay per mile for additional miles)

- Fuel delivery up to five miles (pay per mile for additional miles)

- Tire changing service (with spare provided by customer)

- Lockout services

- Jumping services

Just call 1-800-847-2869 with your name, location and service issue. You’ll be required to pay a negotiated rate (currently $79.95 per call with no limit on calls made) and any additional mileage at the time of service request. Additionally, they will dispatch assistance while on the phone with you. I’d save that number in my phone right now!

Keep in mind this is also a benefit of Chase Sapphire Reserve® that isn’t talked about much – but the service fee is capped at $50/fee up to four calls per year. You can read more about the Sapphire Reserve here!

SHOPPING BENEFITS

Monthly Free 7-11 Pick Up and Dash Pass Membership

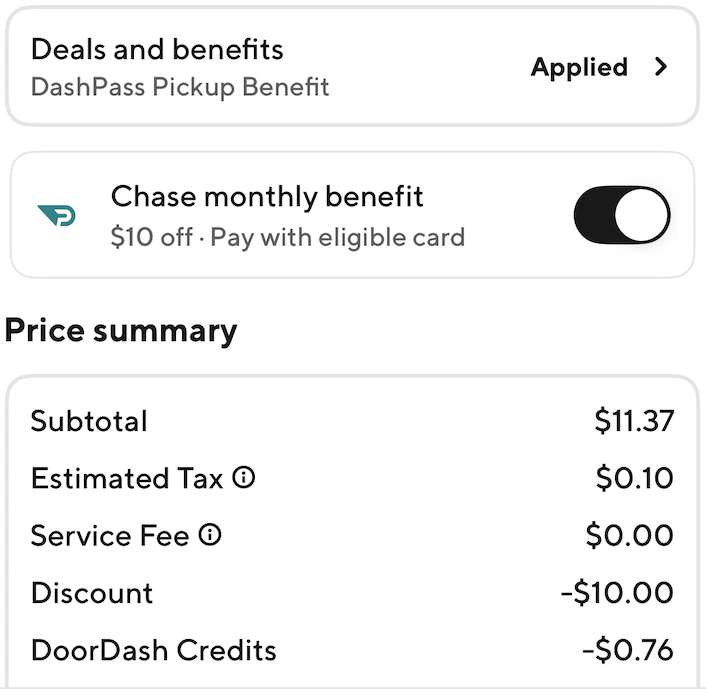

Chase and DoorDash have a partnership through the end of 2027. As a result, this allows you to take advantage of a monthly $10 credit along with a free DashPass membership. Simply add your card to your DoorDash account and activate your free DashPass membership for a whole year. And you get a monthly $10 credit to use on convenience or grocery store purchases within the Door Dash app.

Dash Pass normally costs $9.99 monthly or $96 annually and includes $0 delivery fees, reduced service fees, and the $10 credit each month.

Typically I choose “pickup” within the DoorDash app to avoid any delivery fees or tipping. Place your order in the app and simply activate the $10 Chase credit. You’ll see the discount immediately.

Just like that, you have $10 worth of goodies each month. I’ll be totally honest – I struggle finding pick up availability. I typically use mine at 7/11 to stock up on snacks for the kids, pizza, hot pockets, a 12 pack of Coke Zero. At first, I was only getting Ben & Jerry’s, but with about 6 of these credits to burn a month, I had to reel it in, so I’ve been creative lately. Think Christmas stockings, Easter baskets, airplane treats and sports snacks!

Whatever you choose to buy with your monthly credit, this savings adds up to $120/year – as a result, you already are net positive on the $95 annual fee!

Extended Warranty Protection

When using your CSP for purchases, you’ll enjoy an additional year of warranty free of charge when the manufacture warranty is three years or less. Coverage is up to $10,000 per claim and a maximum of $50,000 per account.

To file a claim, submit purchase receipts and proof that the original manufacturer warranty is outdated within 90 days of product failure.

Purchase Protection

Eligible purchases made with the Sapphire Preferred card enjoy purchase protection for 120 days from date of purchase for loss or damage. Claims may be up to $500 per claim and up to $50,000 annually.

To file a claim, call the number on the back of your card or head direct to the online benefits administrator page to file online.

While not used often, this hidden benefit can come in handy with small electronics and things that are easily broken like Airpods, headphones, and cameras.

Conclusion

All in all, the Sapphire Preferred card is a powerhouse card with several hidden benefits. The benefits on this card definitely exceed the $95 annual fee. As a result, this card is staying in my wallet for the long haul.

xoxo, Amber

Want to chat? Have questions? Contact me here.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.

Amberonpoints is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. We appreciate it when you use our affiliate links as it supports our content at no cost to you!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.