Advertiser DISCLOSURE

Marriott’s 50,000-point Free Night Certificates are one of the most flexible — and misunderstood — hotel awards out there.

At first glance, a “50K cap” might not sound especially exciting, especially in a world of dynamic pricing and rising hotel costs. But when you understand how these certificates work, how to top them off with points, and where they offer the best value, they can unlock exceptional stays — from beachfront resorts to spacious family-friendly hotels and international city properties.

Whether you have one certificate or several, the strategy is the same:

know the rules, understand your flexibility, and target properties where these awards stretch far beyond their face value.

In this guide, we’ll walk through:

- What 50K Free Night Certificates actually are

- The most common misconceptions (and how to avoid them)

- Smart ways to use them for maximum value

- Real-world examples of where they shine

- And why, at times, travelers find themselves with multiple 50K certificates at once

Check out the current Marriott Bonvoy Boundless® Credit Card offer.

What Is a 50K Marriott Free Night Certificate?

A 50K Free Night Certificate is an award night that can be redeemed at Marriott properties costing up to 50,000 points per night — with some important flexibility built in.

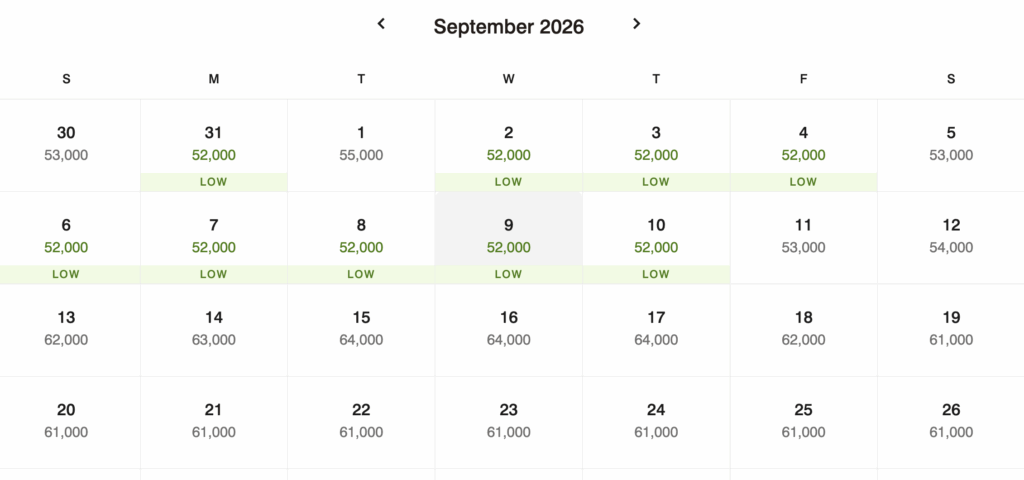

Unlike fixed-category awards, these certificates work within Marriott’s dynamic pricing model, which means timing and flexibility matter more than ever.

How These Free Night Certificates Work

Before we get into redemption ideas, let’s clear up the most common misconceptions.

What You Can Do

- Use one certificate per night (up to 5 nights total).

- Stay at any Marriott property priced at 50K points or less.

- Top off each certificate with up to 15,000 Marriott points. Don’t have 15k Marriott Points? Marriott is a transfer partner of Chase.

- This means you can book properties costing up to 65K points per night

- Use them for family-friendly resorts, city hotels, or international stays

What You Can’t Do

- You do NOT get the 5th night free when booking with certificates

- You cannot combine certificates into one higher-value night

- You cannot extend the expiration date

💡 Pro Tip: Because Marriott uses dynamic pricing, flexibility with dates can dramatically improve the value of these certificates.

Best Ways to Use 50K Free Night Certificates

The sweet spot for these certificates is upper-midrange hotels and off-peak luxury properties. Here are some excellent redemption ideas.

Resort & Leisure Redemptions

Hawaii

- Waikoloa Beach Marriott Resort & Spa

- Courtyard by Marriott King Kamehameha’s Kona Beach Hotel

- Residence Inn By Marriott Maui Wailea

💡 Many Hawaii Marriotts price between 45K–65K points depending on season.

Caribbean and Mexico

- Courtyard By Marriott Aruba Resort

- JW Marriott Cancun Resort & Spa

- Marriott Cancun, An All Inclusive Resort

- Alaia Belize, Autograph Collection

City Stays & Family-Friendly Hotels

United States

- Gaylord Opryland Resort & Convention Center

- SpringHill Suites by Marriott Anaheim Maingate

- SpringHill Suites by Marriott Chicago Downtown/River North

- JW Marriott San Antonio Hill Country Resort & Spa (This is about an hour and a half from our house and we love going here with our 50k certificates or sometimes even the 35k certificate + 15k points!)

Residence Inns and SpringHill Suites are great for families needing extra space and free breakfast. They’re plentiful in larger cities and family friendly destinations – think Orlando, San Diego, Washington DC, etc.

International Favorites

- AC Hotels across Europe

- Moxy Hotels in high-cost cities

- Marriott & Westin properties in Spain, Portugal, and Eastern Europe

International redemptions often deliver outsized value compared to U.S. stays.

Using Points to “Top Off” for Better Value

One of the most powerful features of this offer is the ability to add up to 15,000 points per night to each certificate.

Example:

Hotel costs 62,000 points per night

Use:

- 50K certificate

- +12K Marriott points (or transfer flexible points from Chase to Marriott)

Result: Luxury hotel night at a fraction of the usual cost

💡 If you already have Marriott points — or plan to earn more — this dramatically expands your options.

Why Some Travelers Have Multiple 50K Certificates

While many Marriott members earn a single free night certificate each year through ongoing benefits, there are times when travelers may find themselves with several 50K certificates at once.

Occasionally, certain Marriott co-branded credit card offers include multiple 50K Free Night Certificates as part of a welcome bonus — sometimes as many as five. These offers aren’t always available, but when they are, they can create an opportunity for:

- A nearly free week-long vacation

- Back-to-back resort nights

- Or multi-room stays for families

If you’re contemplating a Marriott card, the “Five 50K Free Night Certificates” offer can hold great value. In fact, it’s one of the best times I’d recommend to sign up for the card.

So who would benefit from these “Five 50K Free Night Certificate” offers when they come around?

This offer is great if:

- Want multiple free nights instead of one big bonus

- Travel with family and need multiple rooms or longer stays

- Can be flexible with travel dates

- Want a low annual fee Marriott card

Consider Carefully If You:

- Struggle to use certificates before expiration

- Prefer airline miles over hotel points

- Rarely stay at Marriott properties

That said, this guide is designed to help you maximize any 50K certificate — whether you have one, two, or several.

Conclusion

If you’re planning Marriott stays in the next year, understanding how to use 50K Free Night Certificates effectively can make a meaningful difference — especially during periods when earning multiple certificates is possible.

Xoxo, Amber

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.

Amberonpoints is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. We appreciate it when you use our affiliate links as it supports our content at no cost to you!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.