Advertiser DISCLOSURE

If you plan to open 2 credit cards per year, and have your partner open 2 credit cards per year – you will NEVER have to worry about this rule I’m about to explain. BUT if you’re a little extra (like us) OR if you want to be traveling extra (like us) – listen up.

If you’re a fan of rewards credit cards, you’ve probably heard the mention of the infamous “Chase 5/24 Rule.” This rule is HUGE if you’re looking to open multiple credit cards, especially those offered by Chase Bank, which includes some of the best (and my personal favorite) travel cards on the market. Here, we’ll explain what the 5/24 Rule is, how it works, and strategies for maximizing your approval chances – because we all know its the absolute worst getting denied for a credit card.

What is the Chase 5/24 Rule?

The Chase 5/24 Rule is an officially unofficial policy Chase uses when reviewing applications for most of its credit cards. It’s simple but strict: if you’ve opened five or more personal credit cards (from any issuer) in the past 24 months, Chase will likely deny your application for a new card. It applies regardless of your credit score, income level, or overall creditworthiness (is that a thing?😂), so even well-qualified applicants can be affected.

For instance, if you’ve opened five new credit cards in the last two years, applying for a popular Chase card, like the Chase Sapphire Preferred® Card (this is the first card I ALWAYS recommend to beginners!) or the Chase Freedom Unlimited®, will likely result in a rejection.

Exceptions: A few Chase cards may be exempt from this rule, but these exceptions are rare.

How Does the 5/24 Rule Work?

The 5/24 Rule counts all personal credit cards opened in the last 24 months, even those from other banks. Here’s how it breaks down:

- Credit Cards Counted: The rule includes personal credit cards from Chase and other issuers, such as American Express, Citibank, Bank of America, and Capital One. Even store credit cards from retailers like Old Navy, Home Depot, and Amazon can count (you know how I feel about these store credit cards – don’t open them. In my opinion, they are rarely worth filling up a 5/24 slot).

- Business Cards Impact: Generally, business cards don’t count toward the 5/24 limit, as they don’t typically appear on your personal credit report.

- Authorized User Accounts: Accounts where you’re an authorized user may count toward your 5/24 tally. However, if these push you over the limit, you can often call Chase to explain, and they may disregard these accounts, or even remove them. In general, I recommend not adding your spouse/partner as an authorized user. If you want to share a credit card, I’d recommend adding the card to your partners digital wallet. The ONLY card that I have added an authorized user on is my Capital One Venture X Rewards Credit Card. Why? The Venture X allows me to bring 2 guests in Priority Pass airport lounges. I have 3 kids. Instead of picking my favorite (which I could probably do quite easily), I have added my husband as an authorized user which allows him to enter the lounge PLUS 2 more guests. This creates family harmony (saves us tonsss of money on expensive airport food) – and I’m here for it.

Strategies for Navigating the 5/24 Rule

If you’re interested in Chase’s credit cards but are close to or have exceeded the 5/24 limit, here are some strategies to work within the rule:

- Space Out Card Applications: Avoid opening too many cards in a short period. I recommend spacing applications 90 days apart. Here’s the rule of thumb we follow in my home: Amber Personal Card ➡️ Devin Personal Card ➡️ Amber Business Card ➡️ Devin Business Card ➡️ repeat process

- Consider Business Cards: Business cards from most issuers (such as American Express, Citibank, or even Chase itself) typically don’t show up on your personal credit report, meaning they usually won’t count toward your 5/24 limit. If you have a small business or a side hustle such as tutoring, owning an investment property, photography, or selling things on Facebook Marketplace, consider a business card to continue earning rewards without impacting your 5/24 status. Read my blog article here for more info on How to Open a Business Card without a Traditional Business.

- Remove Authorized User Accounts (If Necessary): Really, I’d just slap your hands and say “don’t do it again,” but if you feel like you MUST remove yourself as an authorized user, contact the bank and ask if you can be removed as an authorized user.

- Target Cards Outside Chase After Reaching 5/24: If you’ve hit the 5/24 limit, focus on business cards from issuers that don’t follow such strict rules, like American Express or Citibank. This approach lets you continue building rewards while you wait for your status to reset with Chase.

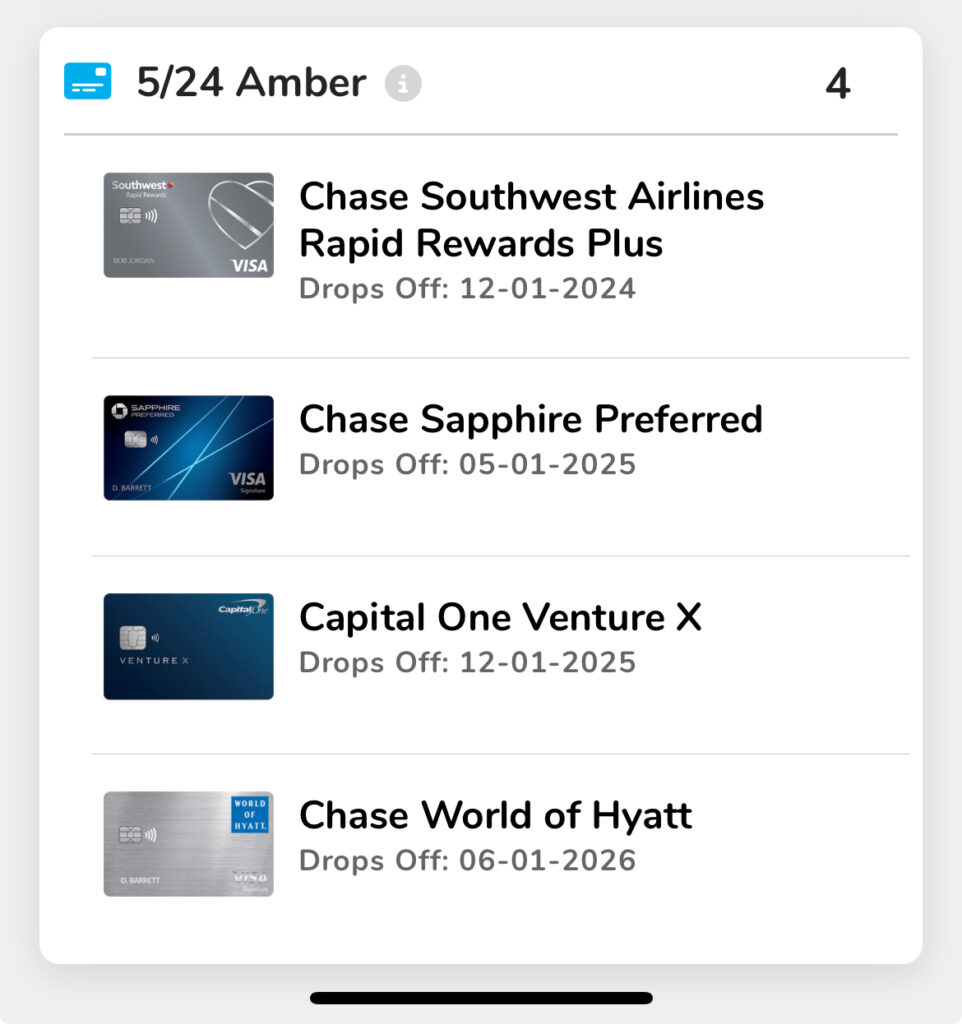

- Track Your Applications: Using a simple spreadsheet or an app to track your credit card applications can help you stay aware of how close you are to the 5/24 limit. I LIVE BY my Travel Freely App (affiliate link but it costs you nothing!). This requires NO sensitive information and even sends me an email when one of my annual fees are approaching!

By understanding the 5/24 Rule and how it impacts your credit card application strategy, you’ll be set up for long term travel rewards success. This is the only way we have been able to do this since 2013. In my opinion, slow and steady (but probably faster than you’re doing it now…🤣 wins the race). We want to protect our credit score while earning huge chunks of travel rewards. Whether you’re a points enthusiast or just starting, staying mindful of this rule will help you travel smarter and maximize your rewards. Let’s get you traveling (on points)!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.

Amberonpoints is part of an affiliate sales network and receives compensation for sending traffic to partner sites such as MileValue.com and Bankrate.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. We appreciate it when you use our affiliate links as it supports our content at no cost to you!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or MasterCard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

EDITORIAL NOTE:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included with the post.